Just how hard is it to disclose Carbon Emissions? Ten Examples.

28.01.2013

As we go into the home straights with the CRRA '13 voting period nearly over (did you vote? if note, you can do so here!), it's time to take a look at the shortlist in the Best Carbon Disclosure category.

As with the other categories, there are 10 shortlisted reports.

Reports in the Best Carbon Disclosure Category

Alcatel-Lucent: Corporate Responsibility Report 2011

Banco Bradesco SA: Sustainability Report 2011

British Sky Broadcasting Group plc: Bigger Picture Report 2012

Coca-Cola Enterprises Inc : Corporate Responsibility & Sustainability Report 2011/2012

Gas Natural SDG SA: Carbon Footprint Report 2011

Hess Corporation: 2011 Corporate Sustainability Report

Hydro Québec: Sustainability Report 2011

Hyundai Engineering & Construction Co: Sustainability Report 2012. We Build Tomorrow

Royal Dutch Shell plc: Sustainability Report 2011

Xstrata plc: Sustainability Report 2011. Creating shared value

The category description for Best Carbon Disclosure is simple: "Which report gives the best disclosure of the organisation’s carbon emissions, the implications for climate change, and the mitigation measures taken? Check for policy, quantified data, targets."

Carbon emissions disclosure is a rather broad topic. As you all know, the GHG Protocol divides Carbon Emissions into three Scopes: 1 (emissions we generate), 2 (emissions we buy that someone else has generated), and 3 (emissions generated by someone else while working on our behalf).

My acid-test is how easy it was for me to find the answer to three simple questions:

What are the absolute Scope 1, Scope 2 and Scope 3 emissions for this company in 2011?

Has this company generated more or fewer absolute carbon emissions during the past 5 years?

Does this company have a target to reduce carbon emissions during the next 2-5 years?

Interested? Let's see what we found:

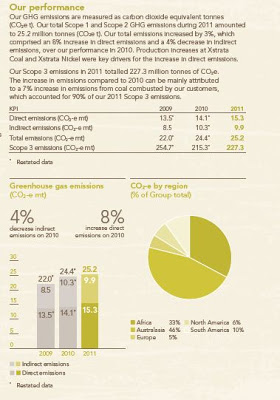

XSTRATA: ease of getting to the data: 5

- Reports all three Scopes and overall total.

- Generated more emissions over three years in all three scopes. Scope 3 is due to customers combusting more coal. Scope 1 and 2 increases are not explained.

- I could not find a specific emissions related target 2012 and beyond.

ROYAL DUTCH SHELL: ease of getting to the data: 6

- Reports on Scope 1 and Scope 2 and makes a comment about Scope 3 "we estimate that the CO2 emissions from the use of our products were around 570 million tonnes in 2011." (For perspective, Shells Scope 1 and 2 emissions were 75 million tonnes)

- Generated fewer Scope 1 emissions versus 2010 but more than 2009; Scope 2 emissions remained the same as 2010 but more than 2009.

- I was not able to locate a specific target for improving carbon emissions performance.

HYUNDAI ENGINEERING: ease of getting to the data: 8

- Reports on Scope 1, 2 and 3 with three year data.

- Total carbon emissions reduced in 2011 versus 2010 and 2009

- Hyundai Engineering has quantified targets through to 2020 and a Green Management roadmap which shows how to get there.

HYDRO QUEBEC: ease of getting to the data: 7

- Reports on Scope 1 and 2 with four year data.

- Total emissions increased versus prior year.

- I was not able to locate a specific target for improving carbon emissions performance.

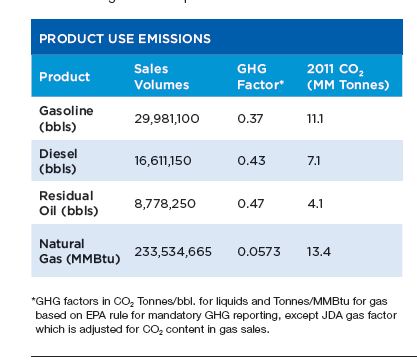

HESS CORPORATION: ease of getting to the data: 4

- Reports on Scope 1 and Scope 2 emissions with three year data and a one year estimate for 2011 for Scope 3 product use emissions. "We estimate our 2011 Scope 3 emissions from product sales at 35.7 million tonnes of CO2e in 2011, of which approximately 45 percent was related to product use in mobile sources and 55 percent to product use in stationary sources."(For reference, Hess's total emissions in 2011 were 5.1 million tonnes CO2e). In addition, Hess mentions a further 230,000 tonnes of emissions due to third party trucking and logistics and a further 22,700 tonnes for employee travel. It wasn't that easy to understand all of this without really really concentrating....

- Absolute GHG 2011 emissions were higher than in 2010 or 2009.

- Hess has a GHG intensity (not absolute) target reduction of 20% by 2013 using 2008 as a baseline.

GAS NATURAL: ease of getting to the data: 4

This is actually a standalone carbon footprint report so you might expect it would be pretty focused, although the volume of data actually did not make it easier to locate specific numbers.

- Reports Scope 1, 2 and 3 for three years, absolute emissions

- 2011 absolute emissions were higher than 2010

- There is a Scope 1 and 2 target for 2014 carbon emissions reduction

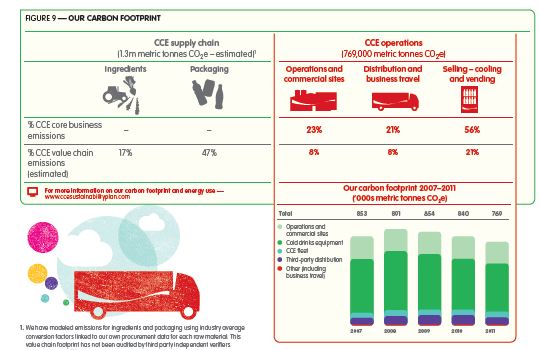

COCA COLA ENTERPRISES: ease of getting to the data 6

- Reports Scope 1,2 and 3 for 5 years

- Absolute emissions reduced each year.

- Coca cola has a target covering 13 years: "Our new target is to halve the carbon emissions involved in making a liter of product between 2007 and 2020 by driving efficiencies in our facilities and investing in renewable energy."

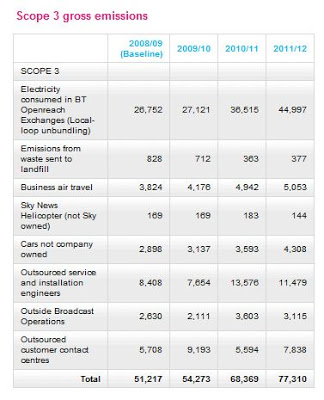

BRITISH SKY BROADCASTING GROUP: ease of getting to the data 6

I had to use the GRI Index on the British Sky website to get to the Carbon Emissions data, as the direct navigation route wasn't all that clear. Once there, I found nicely presented data. Here is the page link to the online report section - this data is not included in the PDF summary report.

- Reports Scope 1, 2 and 3 for four years

- Absolute gross emissions reduced each year versus prior two years

- Target: 25% reduction in gross CO2e emissions (tonnes/£m turnover) by 2020 versus a 2008/09 baseline

BANCO BRADESCO: ease of getting to the data 0

No data was included in the printed download report, and I had to use the GRI Index which directed me to the Banco Bradesco Banco de Planeta website for this. On the English website version, there is an interactive data chart that displays data in graphs. After trying to play around with this for a while, to actually get a view as to whether the carbon performance is improving or otherwise. Also the data charts only include 2010, when the reporting period is noted as calendar year 2011. Therefore, not only was this a major effort to get to the data, I found there is actually no data. I didn't bother then looking for targets.

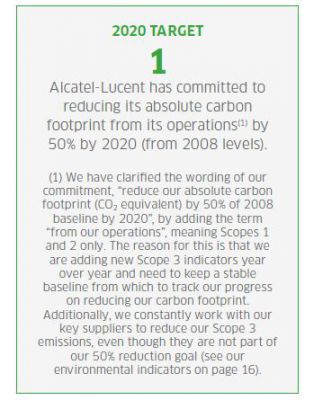

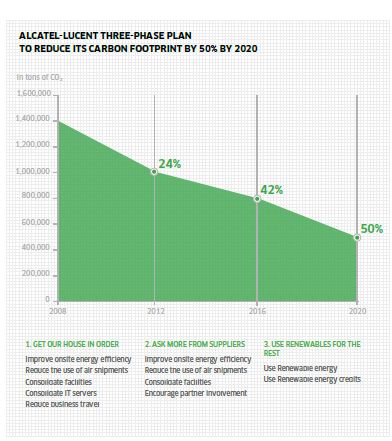

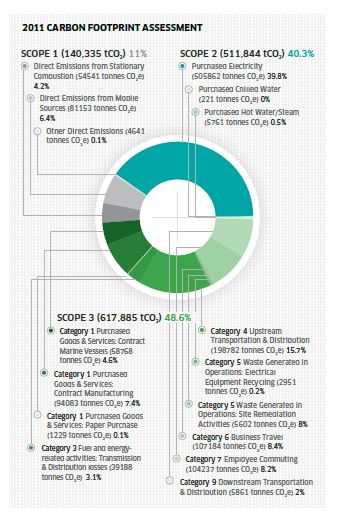

ALCATEL LUCENT: ease of getting to the data: 9

- Reports detailed Scope 1, 2 and 3 data for one year, with a visual overview since 2008 of total emissions

- Absolute emissions have reduced versus prior year.

- Sets a detailed emissions reduction target and pathway to achieve it

Note: One thing I didn't check was whether the above companies reported date for 100% of global operations, or only partial operations. Obviously, I also did not make an assessment of the carbon management performance of the reporting companies, just the way they reported.

What can we learn from all of this ?

Carbon emission data is mostly not easy to find:

My non-scientific ease-of-getting-to-the-data measure (scale 0-10, where 10 is best) shows that the range is between 0 and 9, with most companies coming out somewhere in the middle. Even though companies use the GRI Framework, and nine of the ten reports above do so (including six at A+ level), it is still not easy to go directly to the data and understand how the company performance is actually trending in a consistent and easy way. While the GRI Index is useful as a fallback, I don't want to have to work through a Sustainability Report indicator by indicator. I want to find the right section in the content index and navigate directly to the page. In this sense, the Alcatel-Lucent hyperlinked PDF report was the easiest and most gratifying in terms of looking for carbon emission data and finding everything I wanted quickly and efficiently. Companies need to get better at presenting data in reports in a way which makes them easy to navigate. Readers do not have patience. This is the age of instant. If I don't find the data in an instant, I am off. Banco Bradesco take note.

Scope 3 is catching on:

In these ten examples, most companies addressed Scope 3 emissions in some form, even if they have only been able to estimate data at this stage. This is a good development, as we know that for most companies, this is the significantly bigger area of opportunity and impact. The new G4 guidelines, if launched as proposed, require Scope 3 reporting. Anyone who's not considered that yet would be advised to start doing so.

Target setting is patchy:

Only four of these ten companies actually specified an absolute emissions reduction target. A few more companies specified intensity targets. However, I always say that the planet doesn't care about intensity. Companies should commit themselves to a specific absolute emissions reduction target. Making a public commitment is key to managing performance accordingly.

Finally, voting for CRRA'13 ends soon (officially at end January) so please vote and give the companies that do it best a little encouragement! Vote here!

Write a comment about this page

About Us // Privacy Policy // Copyright Information // Legal Disclaimer // Contact

Copyright © 2012-2018 macondo publishing GmbH. All rights reserved.

The CSR Academy is an independent learning platform of the macondo publishing group.

Your comments are provided by your own free will and you take sole responsibility for any direct or indirect liability. In order to maintain the highest discussion quality, all comments will be reviewed by our editors. You hereby provide us with an irrevocable, unlimited, and global license for no consideration to use, reuse, delete or publish comments in accordance with our Community Guidelines.